Horizon Cloud

Hospitality software provider equips their customers with a collection of inventive products to drive success.

Horizon Cloud serves up swift innovation and growth with Worldpay for Platforms as their single payments partner

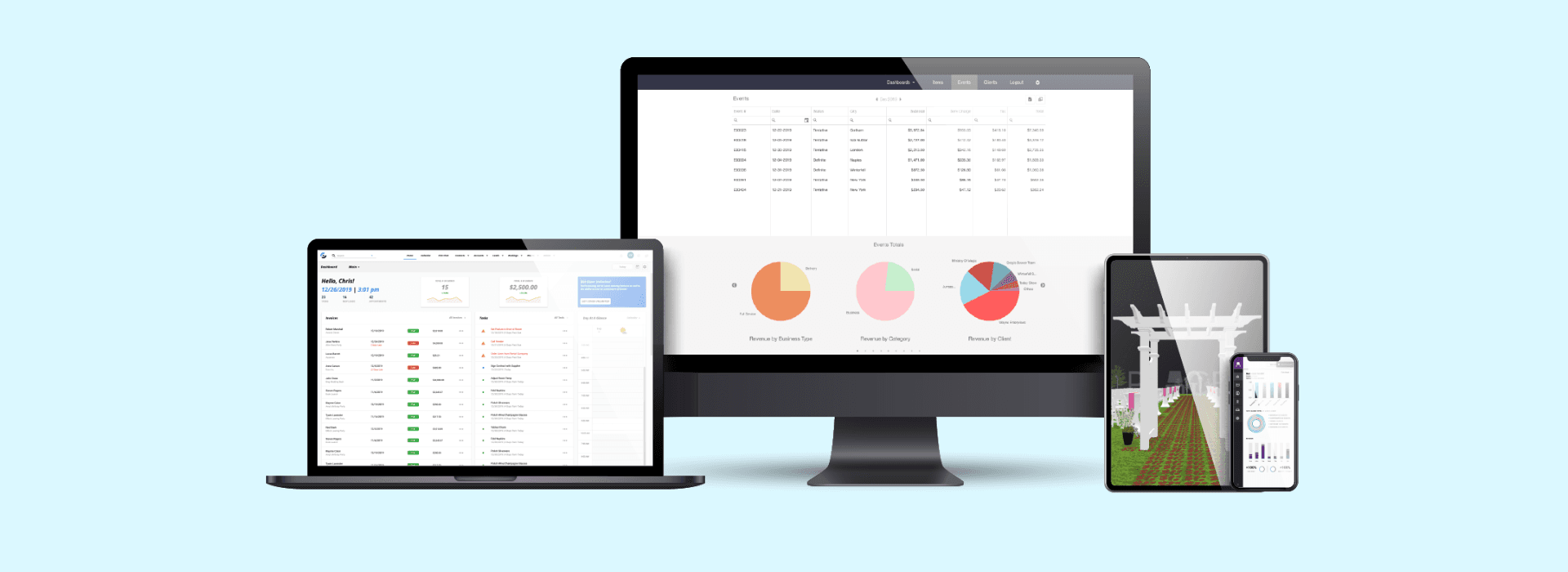

Based in Naples, Florida, Horizon Cloud is a fast-growing software provider for the hospitality industry. Their products range from a catering and event management platform, a hospitality management platform and room diagramming and visualization software.

Horizon Cloud’s customers’ payment needs evolved rapidly, spurring the company to seek a partner that could deliver customization, centralization and intelligent fraud protection, while also supporting their users’ desire for seamless access to innovative financial products.

Worldpay for Platforms became a pillar of Horizon Cloud’s payments strategy, enabling them to streamline operations, minimize fraud and empower their customers with a collection of innovative products.

Challenges

Horizon Cloud needed a single payments partner who could keep pace with their rapidly evolving customer needs, offer seamless integration and provide advanced fraud protection. Their users – particularly caterers – expect modern payment methods, like Tap to Pay for quick POS transactions, and repeatedly requested access to working capital.

Horizon Cloud also faced targeted card-testing attacks, making intelligent fraud prevention a critical requirement in a payments partner. A single, centralized portal for all financial services was on the top of their list of partner must-haves, so Horizon Cloud could simplify the experience for their internal team and software users.

Worldpay for Platforms

Horizon Cloud partnered with Worldpay for Platforms to establish a scalable foundation and deliver a deeply integrated, centralized payment solution. With the PayFac-as-a-Service offering and financial services embedded into their platform experiences, new products and innovations enabled users to simplify operations with quick and easy transactions.

The introduction of Working Capital also allowed platform users to access funding directly within the payment portal, with seamless, frictionless sign-up and repayment.

According to Elizabeth Black, VP, product, fintech and ops, at Horizon Cloud, “Worldpay’s best-in-class fraud protection tools are extremely nuanced and allow us to target specific card-testing attacks in real time with logic-based rules and detailed transaction analysis. Additionally, Worldpay has been instrumental in providing the customization, centralization and steady cash flow to our user base.”

Dedicated partner success and technical managers from Worldpay continue to work closely with Horizon Cloud to ensure alignment on future goals and vision.

Results

- Centralized, seamless financial services: Users access all payments and financial tools, support and onboarding flows from a single portal experience.

- Innovative product integration: Tap to Pay and Working Capital to meet user demand and drive operational simplicity.

- Advanced fraud protection: Nuanced tools and real-time rules prevent card-testing attacks, safeguarding their user base.

- Accelerated growth: Horizon Cloud attributes their “hockey stick” growth to Worldpay’s technology, integration and partnership.

- Shared vision: Worldpay works closely with Horizon Cloud, aligning future product innovations to continue to drive growth and scale for their platform and users.

At a glance

Objective

Work with a payments partner who could keep pace with the rapidly changing needs of their customer base, offer a seamless integration and provide advanced fraud protection.

Worldpay solutions

Worldpay for Platforms; PayFac-as-a-Service; Working Capital; FraudSight

Impact

- Single, centralized portal

- Simplified operations

- Quick and easy transactions

- Card-testing attacks thwarted

“Worldpay has been instrumental in providing the customization, centralization and steady cash flow to our user base.”

Elizabeth Black, VP, Product, FinTech and Ops, Horizon Cloud

Note: Not all products, solutions or capabilities mentioned in our client stories are available in all geographic regions. Please consult your relationship manager or customer care (existing customers) or sales (prospects) for more information.

Related Insights